The Challenge. Generate performance-return records for millions of accounts, which involves building and storing more than one billion account-return records each night.

The Strategy. Create flexible and highly scalable information-delivery and analysis capabilities; use WebFOCUS to process performance returns and simplify account oversight.

The Results. Increased efficiency and flexibility in reporting rates of return, enabling First Rate to capture the portfolio analysis and performance measurement business of more than 350 institutions and more than 4,000 investment advisors worldwide.

Savvy investors want to know more than just how their portfolios are performing each quarter. They require in-depth analysis based on dynamic, up-to-date information. Investment advisors who can keep their customers abreast of market changes in a clear, concise fashion stand out in this crowded, highly commoditized market. That's why First Rate Investments depends on integration and business intelligence (BI) software from Information Builders as essential components of its First Rate Performance suite of applications.

"What makes our company unique is its BI and information delivery capabilities," says Terry Gaines, managing director and manager of Business Development at First Rate. "We add significant value with our web-based reporting and drill-down capabilities, plus our ability to integrate our application suite with almost any database or computing platform. Information Builders' technology makes these aspects of our solution possible."

First Rate provides software and services to calculate rates of return on investment portfolios for investment advisors and financial institutions. The Arlington, Texas-based company has carved out a lucrative niche by creating a web-based performance measurement solution that reveals minute details within millions of portfolios. Wealth managers, financial advisors, and registered investment advisors use First Rate's software products to deliver portfolio information to their customers.

It's a data-processing-intensive business model. Every night after the market closes, First Rate receives holdings and transaction records for more than two million accounts. The company uses WebFOCUS to generate performance-return records for each investment holding, asset, and style class in every account. On average, this involves creating and storing more than one billion account-return records in about six hours, which works out to more than 40,000 return computations per second.

"The scalability inherent in Information Builders' products is critical to our growth and escalating volumes of data," says Bo McWilliams, managing director and general manager of Managed Hosting Services at First Rate. "We ingest millions of records and create billions. Information Builders helps us meet our service-level agreements without significant new investments in hardware. Keeping costs down means we can offer better services to clients."

Horizontal and Vertical Scalability

Using Information Builders' technology to process a high volume of portfolios in a short period of time enabled First Rate to expand in Europe, and recently to Asia. Thanks to its advanced software products and the underlying WebFOCUS infrastructure, First Rate has captured the portfolio analysis and performance measurement business of more than 350 institutions worldwide, including five of the ten largest domestic trust firms and many of the largest financial institutionsin the U.S.

First Rate takes in about one terabyte of data every evening and processes more than 2.5 million portfolios per hour throughout the night. Business continuity and resilience are of the utmost importance to its clients, such as Bank of America, PNC Bank, and Suntrust. They need assurance that First Rate can fulfill service-level agreements (SLAs) for high volumes of data.

To meet escalating client demands, McWilliams and his team built a robust farm of WebFOCUS servers. Currently, 16 multi-core servers are dedicated exclusively to portfolio processing. The hardware runs in a horizontal configuration and has been optimized with high-speed solid-state drives that WebFOCUS uses for scratch space. First Rate easily replicates the hardware/software footprint and adds servers to scale the environment as needed.

"Using WebFOCUS on this hardware configuration enhances reliability," McWilliams explains. "Spreading the load across multiple machines reduces the risk in case any one machine goes down. We can also dedicate a number of machines to a certain client for a period of time."

Scalability within the farm is founded on capacity per machine, which is 40,000 returns per second. First Rate uses that metric to scale the farm, multiplying it across their 16 servers to determine whether their systems have capacity for each day's total return volume. As First Rate adds clients, they easily add servers to the farm and scale horizontally.

With more than 4,000 investment advisors already using the system, a reporting volume of more than two million statements generated per month, and ambitious plans for ongoing growth, McWilliams is confident that First Rate has established an architecture that meets the escalating load.

First Rate plans to give clients even greater flexibility by using WebFOCUS In-Document Analytics to create interactive statements that utilize Information Builders' patented Active Technologies capabilities. This allows First Rate to embed analytics right in its investment statements. Recipients won't have to access a portal to filter the data or export it to Excel. Each statement includes a dynamic payload of data so they can sort, summarize, and filter it locally.

Similarly, they won't need to print the document to highlight transactions or write comments. That is all accomplished locally within the document, providing advanced end-user analytics for delivery via e-mail.

High-Yield InfoApp™ Delivers Executive View

First Rate has decades of experience measuring portfolio performance and calculating rates of return. The company's corporate officers recently realized they could take these analyses a step further. "We are sitting on a treasure trove of information in our databases so we asked ourselves: How can we help our clients glean insight from all of this data?" recalls Marshall Smith, managing director and general manager of the Products group at First Rate.

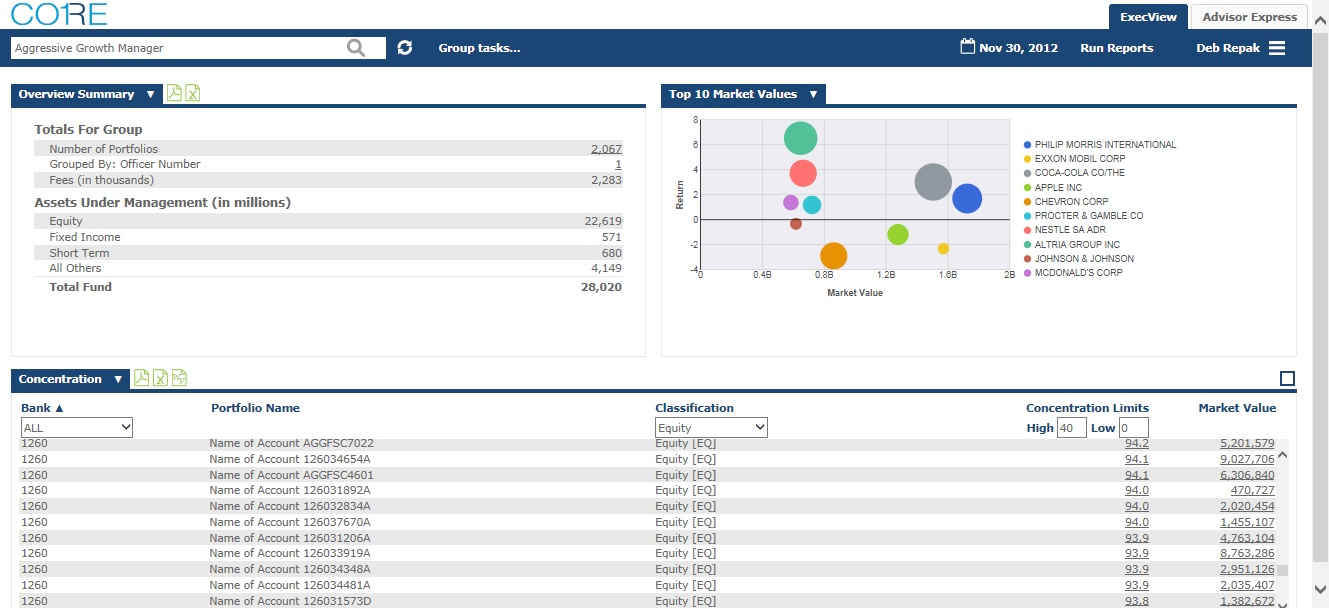

The answer came with an InfoApp™ called ExecView that transforms First Data's massive data set into informational data points to help clients figure out how their businesses are trending. ExecView helps prevent issues with regulatory agencies regarding trading regulations, cash management, and diversification, as well as to help verify the oversight process during an audit.

For example, an investment firm can use ExecView to determine what may be driving increased revenue through fees, or look for areas where accounts and assets under management (AUM) may be decreasing. The InfoApp™ allows them to run checks and balances on individual investment accounts and to fix accounts that are out of line.

According to Smith, it is difficult to create risk-return reports with standard deviations across tens of thousands of accounts, but ExecView creates these reports within seconds. That's a game changer for oversight officers responsible for a group of investment managers or a group of accounts.

"From a monetization standpoint, ExecView has resulted in a 10 percent uptake in our revenue per year as a value-added service," Smith says. "This tool gives them management oversight, even if we're not the vendor who is providing their reporting solution. That's an exciting avenue into new client relationships."

Supporting an Economical SaaS Model

Many clients let First Rate host applications for them, such as the Advisor reporting tool, which reveals details about where their investments are going. With as few as three mouse clicks, Advisor lets them create client-ready presentations and deliver them to investors. "Some of our clients are huge banks with thousands of users, so a thin-client architecture is very economical," Gaines says. "They don't have to load anything on their desktops. All of the application logic resides on our servers."

David Stone, Chief Executive Officer and founder of First Rate Investments, reports that his company's use of WebFOCUS has been an unquestionable success. "Information Builders was able to leverage code that we've had in place for a long time and deliver it through a flexible browser environment," he concludes. "Thanks to Information Builders' broad technology base,

it takes very little work on our part to modify our software solution to suit the requests of individual institutions."